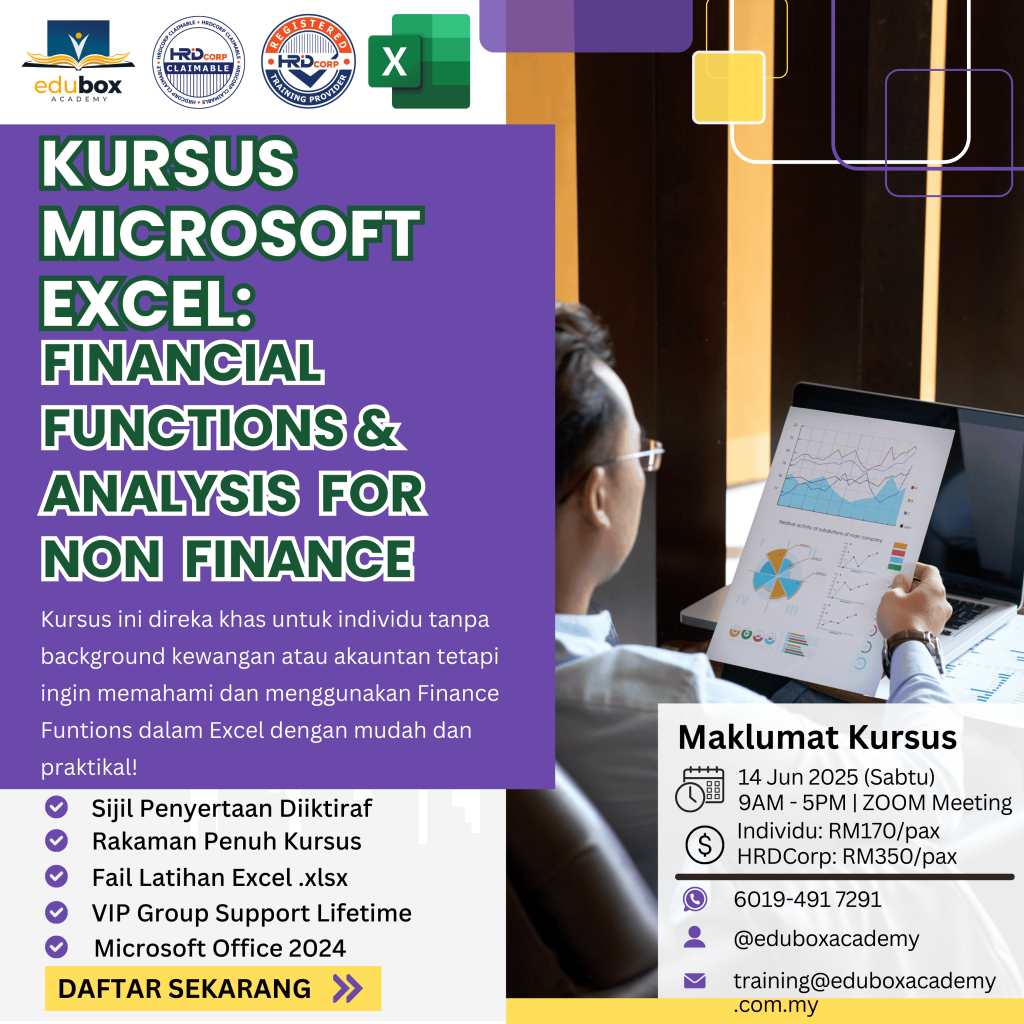

Microsoft Excel: Financial Functions & Analysis for Non-Finance

"In Excel, every formula is a step towards clarity. Embrace the journey of learning, and watch your data come to life"

Join Online training Within Half day

From Your Home (Zoom Application)

DATE: 14 Jun 2025 (Saturday)

Duration

1 Day

time

- 9AM - 5PM

Seats Availability

- 50

Zoom Meeting

Individual Fee

RM 170

HRDCorp: RM350

- VENUE / PLATFORM

- Meals Provided?

- NO

- PC/Laptop Provided?

- NO

- oUR Instructor

Coach Asyraf

(Microsoft Office Specialist: Expert)

Lead Trainer, Data & Business Intelligence Consultant

Microsoft Office Specialist: Expert (Office 2019 & 365 Apps)

Microsoft Certified: Power BI Data Analyst Associate

Microsoft Certified Trainer (2020-2025)

PREREQUISITES

Basic knowledge of Microsoft Excel, including formulas and functions.

No prior financial knowledge required—this course is designed for non-finance professionals.

A laptop with Microsoft Excel (2021 version or MS 365) installed for hands-on practice.

Language

50% English & 50% Bahasa Melayu

Certification

Certificate of Participation by Training Provider

Training Overview

Microsoft Excel is a powerful tool that can simplify financial calculations, helping professionals make informed decisions without requiring deep financial expertise. This one-day training is designed specifically for non-finance professionals who need to understand and apply essential financial functions in Excel for analyzing loans, interest rates, depreciation, future values, and financial returns. Through hands-on exercises, participants will learn how to use Excel to evaluate investment decisions, perform financial forecasting, and analyze key business metrics efficiently.

The course will cover fundamental financial functions in Excel, including calculating loan payments, interest rates, and depreciation, as well as performing investment evaluations such as net present value (NPV), internal rate of return (IRR), and discounted cash flow (DCF) analysis. Participants will also explore Excel’s built-in stock market data features and learn how to apply financial formulas to real-world business scenarios. By the end of the training, attendees will gain confidence in using Excel to analyze financial data effectively, improving decision-making in their organizations.

Course Objectives

At the end of the Course, participants will be able to:

- Calculate loan payments, interest rates, and amortization schedules using Excel’s financial functions.

- Apply depreciation formulas to track asset value changes over time.

- Determine future and present values of investments using Excel formulas.

- Perform NPV and IRR calculations to evaluate investment decisions.

- Utilize Excel’s built-in stock market and currency exchange rate data for financial analysis.

- Automate financial forecasting and projections with dynamic Excel formulas.

- Use logical and date-based functions to perform financial planning and cost analysis.

- Build financial models, including debt and depreciation schedules, with Excel formulas.

- Apply scenario analysis and sensitivity testing for investment decisions.

- Leverage Excel’s data visualization tools to present financial insights clearly.

Course Tentative

TIME | MODULES |

|---|---|

8:30 AM – 9:00 AM | REGISTRATION |

9:00 AM – 10:00 AM | Module 1: Analyzing Loans, Payments, and Interest |

10:00 AM -11:00 AM | Module 2: Calculate Depreciation |

11:00 AM – 1:00 PM | Module 3: Determining Values and Rates of Return |

1:00 PM – 2:00 PM | LUNCH HOUR |

2:00 PM – 3:30 PM | Module 4: Functions and Data Types in Excel for Microsoft 365 |

3:30 PM – 5:00 PM | Module 5: Combining Functions Perform Financial Analysis |

Note: The course duration is a guideline. Course topics and duration may be modified by the instructor based on the knowledge and skill level of the course participant.

Who Should Attend?

This course is ideal for:

Students |

Educators

Office Administrators

Entrepreneurs and Business Owners

Government/Business Professionals

View Course Outline

- PMT: Calculate a loan payment

- PPMT and IPMT: Calculate the principal and interest payments

- Splitting interest and principal payments

- CUMPRINC and CUMIPMT: Cumulative principal and interest

- EFFECT and NOMINAL: Nominal and effective interest rates

- ACCRINT and ACCRINTM: Calculate accrued investments interest

- RATE: Discover the interest rate of an annuity

- PDURATION: Calculate the periods to reach a goal

- NPER: Calculate the number of periods in an investment

- SLN: Depreciation using the straight line method

- DB: Depreciation using the declining balance method

- DDB: Depreciation using the double-declining balance method

- SYD: Calculate depreciation for a specified period

- VDB: Declining balance depreciation for a partial period

- Comparing depreciation functions

- FV: Future value of an investment

- FVSCHEDULE: Future value with variable returns

- Escalating with compounding interest or growth rates

- PV: Present value of an investment

- NPV: Net present value of an investment

- XNPV: Net present value given irregular inputs

- IRR: Internal rate of return

- XIRR: Internal rate of return for irregular cash flows

- MIRR: Internal rate of return for mixed cash flows

- RRI: The interest rate for the growth of an investment

- STOCKHISTORY: Get historical stock prices

- Live stock prices with Stocks data types

- Calculate exchange rates with Currencies data types

- FIELDVALUE: Get field data

- STOCKHISTORY with data types

- Charting STOCKHISTORY with data types

- EOMONTH, EDATE, and timing flags

- Calculate pro data rental costs with date functions

- IF: Building logical comparisons

- Calculating the payback period

- Using RATE or RRI for compound annual growth rate (CAGR)

- Creating a debt schedule

- Using SLN and IF to calculate depreciation

- Creating a depreciation schedule

- Using dynamic arrays to create a depreciation waterfall

- Calculating weighted average cost of capital (WACC)

- Using NPV to calculate a discounted cash flow (DCF)

Training Packages

e-Books

Exercise Files

Tutorial Videos

Lifetime Group Support

Training Video Recording

How to Register

Complete Registration Form

Make Payment

Contact Us

*** Note: Course content and schedule are subject to minor adjustments based on the needs and skill levels of participants.